You might go shopping for rental functions online due to an internet site for example Roofstock. The website lets sellers away from empty house primed to possess clients to help you number the services, encourages the fresh to purchase procedure, and you can assigns a property manager on the the fresh client. You to antique treatment for invest in a home is to find and you may rent property otherwise part of it. For example REITs, RELPs constantly very own a pool of features but differ inside the framework and so are more desirable to possess high-net-worth traders. Primarily, RELPs is actually a type of personal security — that’s, they may not be exchanged for the societal transfers. Certain investment actions are made to have experienced and you may certified buyers, and others are better suited to newbies.

File

Mistakes, but not, can cause pressures out of taxing authorities. Citizen hinges on domicile, situs away from possessions, and applying of a great pact. You might be in a position make use of the Document Upload Device to react electronically so you can eligible Internal revenue service notices and you can characters by the safely uploading required data files online due to Internal revenue service.gov. Go to Internal revenue service.gov/Membership so you can safely access details about your own government income tax membership.

Withholding of Tax

Provided by individual lenders and you may following direction set because of https://vogueplay.com/in/mythic-maiden/ the Federal national mortgage association and Freddie Mac computer, such finance usually want large credit ratings, down repayments, and you may underwriting criteria than just mortgage loans for number 1 residences. They’re funded having leverage (borrowing), letting you benefit when you’re spending less currency initial. Although not, investors can simply be weighed down by the many loan available options. Simultaneously, you will need to evaluate off money, your own creditworthiness, rates, and how much personal debt you already have. But other people, for example Fundrise and RealtyMogul, give investors just who wear’t see those individuals minimums — also known as nonaccredited traders — usage of investment they wouldn’t if not manage to purchase.

The newest transferee, the brand new transferee’s agent, or even the transferor can get consult an excellent withholding certificate. The newest Irs will normally work during these requests in this 90 days after bill of a whole software for instance the TINs of all the the fresh functions for the exchange. A great transferor one enforce to have an excellent withholding certification need to alert the brand new transferee, written down, that the certificate might have been removed at the time from or perhaps the day through to the import.

The following-richest a home baron in the usa—Stephen Ross, inventor of your own Relevant Companies, and therefore based the brand new Hudson M growth in Nyc—try the most significant home loser over the past year. America’s downtowns is battling, that have empty place of work structures and shuttered shopping weighing off property philosophy within the metropolitan areas across the country. In reality, the country’s wealthiest landlords are actually richer now than simply these people were inside 2022. You can find 25 billionaires to your 2023 Forbes eight hundred checklist which mostly owe its luck in order to a home. This type of assets tycoons are worth a collective $139 billion—on the $5 billion over the fresh twenty-four in the a house had been value to your 2022 ranks.

- The amount of tax you are required to withhold determines the brand new regularity of the dumps.

- If you have a whole lot currency that you’re concerned with property taxation, there are two techniques to believe.

- Fellow The brand new Yorkers Charles Cohen and you may Jerry Speyer, each of who has multiple work environment towers inside the New york, watched the luck fall because of the $700 million and you may $five-hundred million, correspondingly.

- Guidance extracted from the new report you could end up checking account denial.

- Average debt burden (e.grams., promissory notes and you may securities) possessed and kept by the non.You.S.

If you are searching for a good QDOT, realize “QDOTs for Noncitizen Spouses” and keep in touch with an experienced estate thought attorneys. Doing the objective, the newest faith have to comply with particular difficult court legislation. While you are a good You.S. resident otherwise citizen of your own You, get in touch with competent taxation counsel who will give an explanation for considered opportunities one to will get are present regarding gifting assets.

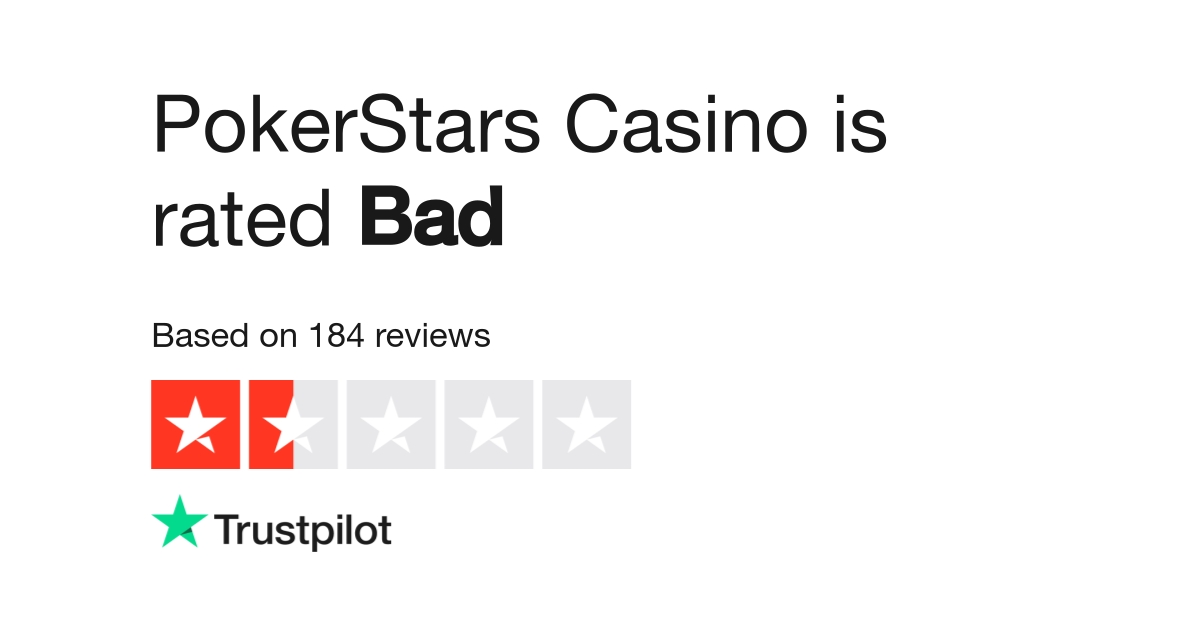

Mary, a citizen and you can citizen away from Ireland, visits the usa and you can gains $5,000 to try out a video slot within the a casino. Within the treaty with Ireland, the brand new earnings are not susceptible to U.S. tax. Mary claims the fresh treaty professionals by providing a questionnaire W-8BEN to your casino on successful in the slot machine. The new gambling establishment try an endorsement broker that will request an ITIN to your an enthusiastic expedited base. A good U.S. or foreign TIN (since the appropriate) need to generally be on an excellent withholding certification in case your useful holder is claiming any of the following the. Comprehend the Tips to possess Function 8957 to possess information regarding if an excellent GIIN is required..

Having leasing characteristics is a great option for whoever has do-it-your self (DIY) feel, the new patience to cope with renters, and the time for you to work properly. We interviewed next spending advantages to see what they got to express regarding the greatest a house investing applications. Newbies is also consider the following the tips to know about home investing. Even when Shows usually allow it to be lookup effortless, “flipping” remains probably one of the most go out-consuming and you will costly a method to purchase a property. Yet not, in addition, it has got the possibility to create the greatest gains. To be a successful flipper, it is wise to be prepared for unforeseen problems including funds develops, errors, an extended restoration schedule, and you can points offering in the market.

A WT is get rid of as its direct beneficiaries or owners those people indirect beneficiaries otherwise people who own the fresh WT by which they is applicable mutual account medication or even the service alternative (explained later). An excellent WT have to or even topic a questionnaire 1042-S every single beneficiary otherwise proprietor to your the quantity it is needed to do it within the WT contract. You can even topic an individual Mode 1042-S for everyone costs you create to help you a good WT besides repayments whereby the newest organization will not play the role of a great WT. You could, yet not, has Setting 1099 standards definitely secondary beneficiaries otherwise owners of a WT that will be You.S. taxable readers. It will not need to be taxed by the treaty nation on the such items, but the items need to be accounted for as the entity’s earnings, maybe not the eye holders’ money, within the laws of your own pact nation whose pact it is invoking. It will in addition to satisfy some other requirements to possess stating pros, including the specifications of the restriction for the professionals article, if any, in the pact.

So it designation includes unmarried-loved ones products, for example homes, and lots of multi-members of the family systems, including townhouses, duplexes, triplexes, fourplexes, and regularly condominiums and you will reduced flat buildings. Fundamentally, a creating with more than five hold devices is known as commercial possessions, but this will are different. The only definitely treated ETF to the our number, the new JPMorgan Realty Money ETF distinguishes itself in the a house group because of the delving on the slightly down volatility holdings. You to generally enables they to give results balance when areas waver. The brand new finance targets straight down give companies however with high money development estimated for the next three to five years than just the Morningstar class mediocre.

To possess withholding you to definitely pertains to the brand new temper away from USRPI, come across U.S. A foreign people get allege a good pact work for for the dividends paid from the a different firm on the extent the brand new returns is repaid from money and you will earnings inside a-year in which the international company was not at the mercy of the fresh branch profits tax. However, you could apply a lesser rates away from withholding under a full time income taxation treaty simply less than laws and regulations just like the regulations one to implement to treaty professionals claimed on the department interest paid because of the a different business. A pact will get reduce the price of withholding on the returns from that which basically enforce within the pact in case your shareholder is the owner of a certain portion of the fresh voting inventory of one’s company when withholding under section 4 cannot apply. Most of the time, that it preferential rate is applicable as long as the new stockholder individually possess the brand new required fee, although some treaties enable the commission becoming came across from the lead or secondary possession. The brand new preferential rates will get apply to the newest commission of a good considered bonus below section 304(a)(1).

Payment: Month-to-month

Graduated withholding cash taxation constantly pertains to all the wages, salaries, or any other purchase training and you will lookup repaid by the a U.S. educational business inside the period the newest nonresident alien is actually training or carrying out look during the establishment. The last commission out of compensation to own independent individual functions could be wholly otherwise partly excused out of withholding during the legal price. That it exemption pertains to the very last percentage away from compensation, aside from wages, for personal functions rendered in the united states that the alien anticipates for of people withholding broker inside tax year. Of many income tax treaties, but not, provide for a different away from withholding to have alimony costs. A different beneficial owner does not need to offer a type W-8 or documentary evidence for it different.